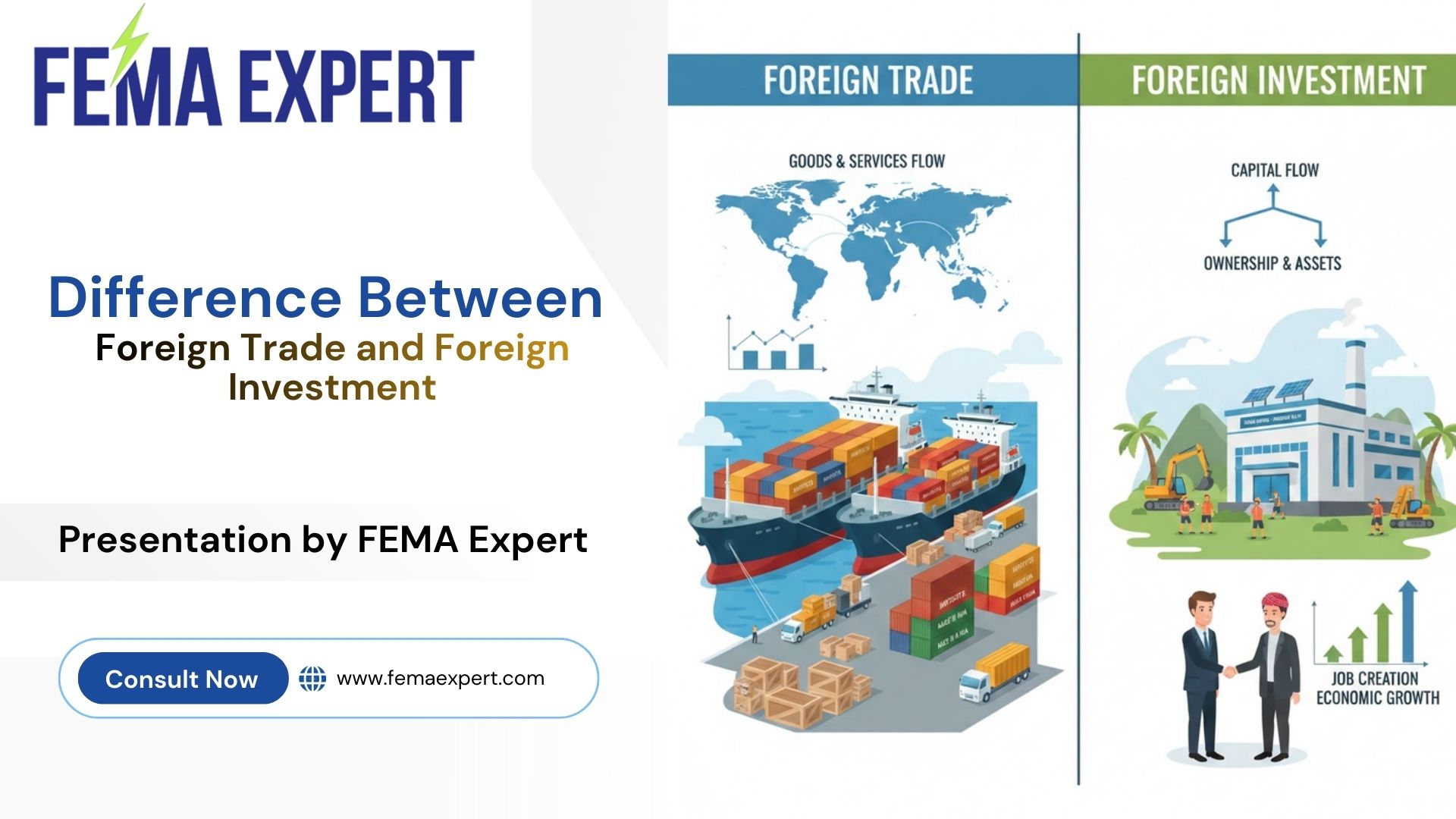

Foreign trade and foreign investment are two pillars of globalization, but they work in very different ways and affect businesses, economies, and even students’ exams in different manners. Understanding the difference between foreign trade and foreign investment helps class 10th students score better in economics, and helps entrepreneurs or MSME owners choose the right route for global expansion. This guide explains both concepts in simple language, compares them side by side, and also shows where a FEMA Expert can help you, especially in the Indian context.

What is Foreign Trade?

Definition of Foreign Trade

Foreign trade (also called international trade) is the exchange of goods and services between two or more countries across national borders. It mainly covers exports (selling to other countries) and imports (buying from other countries) and is a key driver of global economic growth and market integration. For a simple class 10th understanding, foreign trade means buying and selling products or services with other countries in the world market.

Types of Foreign Trade

- Import trade – Purchase of goods and services by one country from another; goods flow from the foreign country to the home country.

- Export trade – Sale of goods and services from the home country to other nations; goods move from home to foreign markets.

- Entrepot (re-export) trade – Importing goods from one country and then exporting them to another after minimal or some processing.

Key Features of Foreign Trade

- It involves cross-border transactions of goods and services, usually governed by trade agreements, tariffs, and customs rules.

- The focus is on tangible products and services rather than ownership or control in a business.

- Payments are typically settled in foreign currency, so exchange rates directly affect profitability.

- Many foreign trade transactions are relatively short-term in nature: once goods are shipped and paid for, that specific deal ends.

Examples of Foreign Trade

- An Indian company exporting textiles, spices, or IT services to the United States or Europe is engaged in foreign trade.

- An Indian manufacturer importing high-tech machinery from Germany or Japan for its factory is also part of foreign trade.

What is Foreign Investment?

Definition of Foreign Investment

Foreign investment is the investment of capital (money or assets) from one country into businesses or assets located in another country, with the expectation of returns or long-term benefits. It usually creates a lasting interest or ownership stake in a foreign enterprise, beyond just a one-time trade transaction.

Types of Foreign Investment

- Foreign Direct Investment (FDI) – When an individual or company acquires a significant ownership stake (commonly 10% or more) or sets up business operations (like a factory or subsidiary) in another country.

- Foreign Portfolio Investment (FPI) – When investors buy financial securities such as shares, bonds, or mutual funds of foreign companies without seeking direct management control.

(Some sources also mention Foreign Institutional Investment (FII) as a form of institutional portfolio investment.)

Key Features of Foreign Investment

- It usually represents a long-term commitment of capital in the host country’s economy.

- The investor often gains ownership or at least some level of influence or control in the foreign business, especially in the case of FDI.

- The main focus is on capital growth, returns, technology access, and strategic presence rather than buying/selling goods.

Examples of Foreign Investment

- A multinational company building a manufacturing plant or IT centre in India is making foreign direct investment.

- An Indian investor buying equity shares in a listed US company through an international brokerage account is making a foreign portfolio investment.

Difference Between Foreign Trade and Foreign Investment

Below is a simple table to clearly show the difference between foreign trade and foreign investment, useful for class 10th and above.

| Basis | Foreign Trade | Foreign Investment |

|---|---|---|

| Meaning | Exchange of goods and services between countries in the international market. | Investment of capital to acquire assets or ownership stakes in a foreign country. |

| Nature | Generally short-term; each deal closes once goods are delivered and paid for. | Long-term commitment aimed at sustained returns and presence. |

| Control | No ownership or control in the buyer’s or seller’s business; the relationship is transactional. | Often includes ownership or significant influence in the foreign business (especially FDI). |

| Risk | Typically lower risk per transaction, but exposed to price and exchange-rate swings. | Higher risk due to political, regulatory, and market uncertainties in the host country. |

| Objective | Profit from buying and selling goods/services and expanding market reach. | Business expansion, strategic presence, technology access, and long-term capital gains. |

| Example | Exporting garments, importing crude oil, or re-exporting processed goods. | Setting up a factory abroad or buying shares in a foreign company. |

For “difference between foreign trade and foreign investment class 10th,” you can remember: trade = buying/selling across borders, investment = putting money into foreign businesses or assets for long-term returns.

Key Benefits of Foreign Trade

- It expands market reach by allowing domestic producers to sell to customers worldwide, increasing sales and scale.

- It promotes efficient use of resources as countries specialize in what they are relatively better at producing.

- It gives consumers access to a wider range of products, technologies, and better quality at competitive prices.

- It helps boost GDP, employment, and foreign exchange reserves of a country.

Key Benefits of Foreign Investment

- It helps businesses expand globally without bearing all costs alone, as foreign capital supports growth.

- It brings technology, management skills, and new processes into the host country, improving productivity.

- It creates jobs and improves income levels in the host country, supporting long-term economic development.

- It deepens financial markets and improves access to capital for domestic companies.

Risks and Challenges

Foreign Trade Risks

- Profitability can be hit by exchange rate fluctuations between currencies.

- Countries may impose tariffs, quotas, or non-tariff barriers that increase costs or restrict certain imports/exports.

- Logistics issues like shipping delays, port congestion, or supply-chain disruptions can affect deliveries and customer satisfaction.

Foreign Investment Risks

- Political instability, policy reversals, or changes in government can affect investor confidence and asset safety.

- Complex regulatory and compliance requirements, especially under laws like India’s Foreign Exchange Management Act (FEMA), can create legal risk if not handled correctly.

- Large capital exposure means higher financial risk if the project fails, demand falls, or regulations change.

Check :- What Changed in India After FEMA Act 1999?

For Indian businesses or investors, working with a FEMA Expert or FEMA consultant is highly advisable to ensure foreign investments and related transactions comply with FEMA, RBI guidelines, and reporting norms.

Relationship Between Foreign Trade and Foreign Investment

- Many companies start by exporting to a foreign market, and once demand grows, they set up a local unit there—moving from foreign trade to foreign investment.

- Strong trade relations between countries often encourage investors to commit capital because markets and regulations are already familiar.

- Both foreign trade and foreign investment contribute to globalization, technology diffusion, and long-term economic growth.

Which is Better: Foreign Trade or Foreign Investment?

- For small businesses and beginners, foreign trade is usually safer because it requires less capital and offers quicker, transaction-based returns.

- Foreign investment suits companies or investors who have clear long-term strategies, risk appetite, and compliance support (such as FEMA Experts in India).

- In practice, successful global businesses use a mix of both: they trade to test markets, and invest when they see stable demand and policy support.

Conclusion

The core difference between foreign trade and foreign investment is simple: trade is about exchanging goods and services across borders, while investment is about putting capital into foreign assets or businesses for long-term gains. Both are essential for modern economies, but they differ in nature, risk, control, and objectives, which matters for class 10th students, startups, and large companies alike. If you plan cross-border deals or investments especially involving India consulting a FEMA Expert or cross-border advisory can help you stay compliant and design the right mix of trade and investment for sustainable growth.

FAQs: Foreign Trade vs Foreign Investment

What is the main difference between foreign trade and foreign investment?

Foreign trade means buying and selling goods or services between countries, like exports and imports. Foreign investment means sending money to another country to buy assets or ownership in businesses there, expecting long-term returns.

On Reddit and Quora, many learners ask, “Is foreign trade just about goods, while foreign investment is about money?”—and the concise answer is yes: trade moves products; investment moves capital and ownership.

Is foreign investment riskier than foreign trade?

Yes, typically foreign investment is riskier because it involves large, long-term capital commitments affected by politics, regulations, and market conditions in the host country. Foreign trade has its own risks (prices, exchange rates, logistics) but individual transactions usually carry lower and shorter-term exposure.

Q3: What are examples of foreign trade?

Common examples include a country importing crude oil, electronics, or machinery, and exporting textiles, agricultural products, or software services. Re-exporting goods—importing from one country, doing minor processing, and then exporting to another—is also a form of foreign trade called entrepot trade.

Why do companies prefer foreign investment?

Companies choose foreign investment when they want deeper control over production, branding, and distribution in a foreign market. It allows them to be closer to customers, reduce logistics costs, access local talent, and build long-term strategic presence instead of only shipping goods from home.

On platforms like Quora, a frequent question is, “Why not just export instead of building a plant abroad?” The usual expert-style answer is: exports are good to start, but local investment can cut costs, bypass tariffs, and strengthen the brand in that market.

Can foreign trade lead to foreign investment?

Yes, this is very common: businesses often begin with exports to test demand, and when the market proves attractive, they invest in local offices, warehouses, or factories. In many success stories discussed on Reddit, entrepreneurs first build export orders, and later shift to FDI or joint ventures once they understand regulations, customers, and compliance (often with help from local legal or FEMA Experts in India).